Announcements

ABOUT US

With AACANet, you know you are in good company.

AACANet debuted Pipeway™ in 2006, our online account management portal, giving clients and firms ready access to their accounts. Pipeway™ continues to evolve to meet the growing needs of an ever-changing industry. In 2017, Pipeway™ teamed up with AIM to deliver the first real-time audit and compliance management tool. When integrated with Pipeway™, AIM will allow users direct access to vendor compliance status.

The tools in Pipeway® allow clients to run reports, study graphs and review detailed account information on a select group of accounts or by a single account, tracking activity, cost and performance metrics. The analytical tools of Pipeway help managers better allocate resources to increase profitability.

Firms and agencies find the portal useful when discussing accounts with clients, who can view all activity reported. They are also able to view actions reported by others, run reports on select groups of accounts, measure performance and better manage work flow.

Pipeway® also serves as a platform for:

- the transmission of documents and data to and from AACANet

- a settlement portal which provides seamless interchange on settlement offers with the clients

- news and information

- work standards

The State by State page provides valuable information about laws in each state affecting the ability to collect. Users also have access to AIM, the AACANet audit management tool.

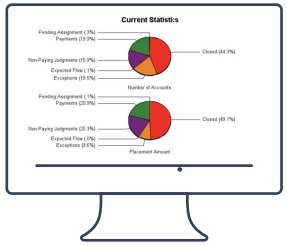

AACANet has designed Pipeway® to allow for quick visualization of groups of accounts, which can be explored in more depth with a simple click. Flexible reports can be run based on a number of factors such as state, portfolio, date and company. The reports also allow users to drill-down to create more in-depth reports for more detailed analysis.

PIPEWAY® PROVIDES USERS:

A secure online

interface to

view account

information

A data platform

enabling

advanced

reporting

All relevant

information in a

simple, yet powerful,

graphic presentation

The ability

to view

individual account

data

A color-coded

system that

enables easy

review

A single location

for all account information,

notices, work standards,

settlements, etc.

The pipes are a unique color-coding given to each account that permits a visual depiction of information for quick analysis and reference. The color-coded "pipes" plot selected groups of accounts "batches" against anticipated timelines and display them in a pie chart. Each slice of the pie is a different color and by clicking on the slice, the user can drill in to get additional information about the accounts in each pipe. Here is what each pipe color means:

GREEN

These accounts are receiving payment or have been settled or paid in full. Accounts in the Green Pipe means the collection efforts have been successful.

BLUE

The account or group of accounts in the Blue Pipe are moving through the process as expected and meeting all current deadlines. The accounts in the blue pipe are being worked as they should, but just are not in a payment status.

ORANGE

The Orange Pipe contains those accounts that are deficient because the anticipated actions have been disturbed and the deadlines have not been met. By analyzing accounts in the Orange Pipe we can often ascertain issues associated with the portfolio, jurisdiction, performance or other factors which may be affecting the collection process. Accounts remain in the Orange Pipe as long as the reason for the delay continues.

PURPLE

Accounts that have resolved their deficiency, but are not back on track, closed or paying will fall into the Purple Pipe. Reports generated on the Purple File can help identify accounts that are slow to progress or judgments where help may be needed to assist with post-judgment collection activity.

RED

These are accounts that have been closed with AACANet without being paid in full or settled in full. Users can run a report or access individual files to review the reasons why the account closed.